Things about Offshore Account

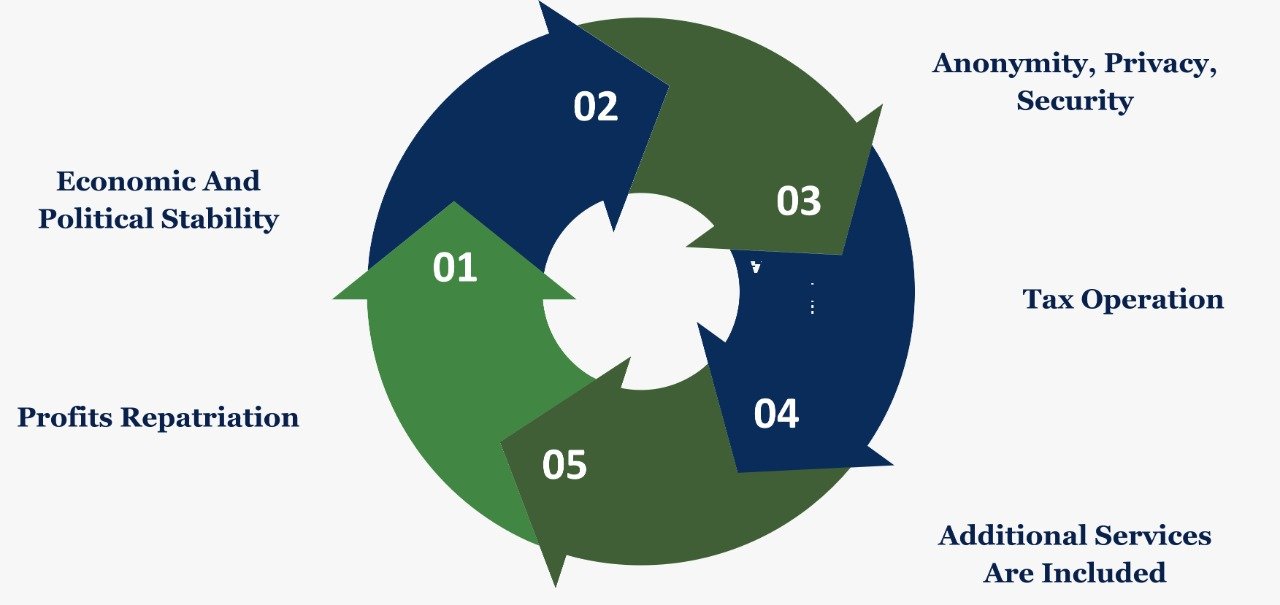

An overseas bank account is often used by those that have little faith in their local banking sector or economic climate, those who stay in a less politically steady nation, those that can legally prevent taxation in their brand-new country by not remitting funds to it, and deportees that want one centralised savings account source for their global financial demands.

Preserving a financial institution account in a country of abode makes substantial and lasting sense for many migrants. Unless you're trying to change your nation of abode and also cut all ties with your home nation for life, keeping a financial existence there will certainly indicate that if ever before you intend to repatriate, the path will be smoother for you.

Your company might demand you have such an account right into which your salary can be paid each month. You might also require such an account to have energies connected to your brand-new residential property, to get a cellphone, rent out a home, raise a mortgage or buy a vehicle.

The 3-Minute Rule for Offshore Account

The important things to keep in mind is that offshore banking isn't necessarily an excellent remedy for each expat. It is very important to understand what advantages and disadvantages overseas banking has as well as how it suits your personal circumstance. To help you make a decision whether an offshore bank account is right for you, right here are the most famous advantages and also drawbacks of offshore financial.

If the nation in which you live has a much less than beneficial economic environment, by maintaining your wide range in an overseas financial institution account you can stay clear of the threats in your new nation such as high rising cost of living, money devaluation and even a successful stroke or battle. For those deportees residing in his explanation a country where you only pay tax obligation accurate you pay right into that country, there is a noticeable tax advantage to maintaining your money in an offshore savings account.

Expats can gain from this no issue where they remain in the world as it can imply they can access their funds from Atm machines or online or over the phone at any time of the day or night, no issue what the moment area. Any kind of rate of interest gained is generally paid cost-free from the reduction of taxation.

The smart Trick of Offshore Account That Nobody is Discussing

Keep in i was reading this mind: professional estate preparation guidance needs to be sought by anybody looking for to gain from such a benefit. Some overseas banks charge much less and also some pay even more passion than onshore financial institutions. This is ending up being less and also less the case nowadays, however it deserves looking closely at what's available when looking for to develop a new overseas checking account. offshore account.

Less federal government intervention in overseas monetary centres can indicate that offshore banks have the ability to supply more interesting financial investment solutions as well as solutions to their customers. You might take advantage of having a partnership manager or personal financial institution account supervisor if you choose a premier or private offshore checking account. Such a service is of benefit to those who desire a more hands-on method to their account's monitoring from their bank.

and allow you to wait for a details rate before making the transfer. Historically banking offshore is arguably riskier than financial onshore. This is demonstrated when checking out the fallout from the Kaupthing Singer as well as Friedlander collapse on the Island of Man. Those onshore in the UK who were affected in your area by the nationalisation of the financial institution's parent business in Iceland obtained complete payment.

The term 'offshore' has come to be associated with unlawful as well as immoral cash laundering and tax evasion activity. Conceivably anybody with an offshore bank account could be tarred, by some, with the exact same brush also though their offshore banking activity is completely legitimate. You need to pick your overseas jurisdiction meticulously.

The 15-Second Trick For Offshore Account

Also, some overseas sanctuaries are less steady than others. It's important to look at the terms and problems of an overseas savings account. Will you be billed higher charges if you stop working to keep a minimum balance, what are the costs as well as fees for the account and the solutions you may wish to use? It can be more difficult to resolve any type of issues that may emerge with your account if you hold it offshore.

And also as well best site as complying with these durable standards, deportees may still be able toenjoy more privacy from an offshore bank than they can from an onshore one. This reason alone is adequate for numerous individuals to open an offshore financial institution account. There can be expat tax benefits to making use of an offshore bank -yet whether these apply in your situation will certainly depend on your individual situations, such as nation of residence.